Bubblicious

Editor's Note

Hello from London!

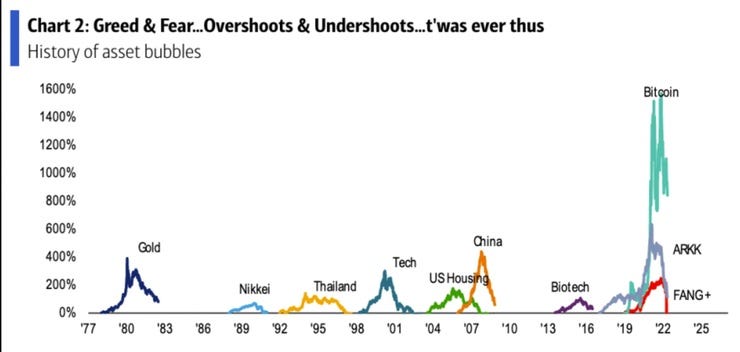

I'm neither a crypto expert nor a finance one. For the latter, please speak to my brother who knows a bit about the money game. For the former, I do have a view (but not an expert one). Over the last few months, a few of you have emailed asking about the bubble bursting on crytpo. My semi-educated view is that if this is a market, we are right at the beginning. But it's a bit more complicated than that especially as there's a lot of uncertainty. An article from last month cited Bank of America's Greed and Fear Asset Bubble Chart (see below). It highlights the bubbles of time gone by. The winners of new markets aren't usually the darlings that win out. Google wasn't first at search, for example. And not everyone wins, so all of these cryptos that launch every other day could be the next big thing or could have the lifespan of a fly - we just don't know. Maybe Pomp knows.

In talking this through recently, I think it's nicely summarised as follows. Firstly what kind of assets are there?:

income producing assets: stocks, bonds and property - which give you income over a period of time such as dividends, rent etc. - but also appreciate.

non-income generating assets: art, crypto and NFTs - you buy because you like them or mostly to speculate.

But the basics of markets come down to two things: what we all learn in economics: supply and demand. With the creation of Bitcoin, the supply was constrained. (Roughly 21M coins, roughly by 2140) It has been a somewhat genius situation in that bitcoins are mined and ultimately should increase in price, as it is expensive to mine - and thus demand should increase. So over the last 5 to 10 years, we have seen the price of bitcoin increase, as demand has increased. Simple economics. But there is a small glitch in this matrix. Supply.

Bitcoin supply is restrained, but there are now nearly 20 thousand different cryptocurrencies, and while Bitcoin and Ethereum may be the larger ones, it feels like there is more supply in this space than we thought (there were probably a few more born since I wrote and you read this note) - in fact, it feels like unlimited supply and thus why we see that speculation is rife. The crypto day trader doesn't care too much about bitcoin. They might hold it as a stable element of their portfolio - but they're really looking for the one-cent currency that will 100x overnight. So the basics of economics still remain in this space - it's just that you need to be very careful about how you define supply.

So, what does this all mean? Expect to see bubbles bursting. They always do. Expect to see turmoil in the crypto markets, until there are a few clear winners. In the meantime, speculators gonna speculate.

Don't take any of the advice above. I'm not qualified! Should you invest in crypto? Do you like bubbles?

Stay Curious,

Onward! - Rahim

Classifieds

Classifieds support the running of Box of Amazing. Book your spot.

The best daily newsletter analyzing the business, finance, and technology industries.

Now

Apps are spying on our kids at a scale that should shock you.

Nice to see Minerva on top of this list.

Near

End Note

Box of Amazing is made possible by some amazing advertisers. For more information and to secure a slot, fill in this form.

If you enjoyed this briefing, would you share this on LinkedIn, Whatsapp or email with your colleagues and friends?